crypto tax calculator australia

Built to comply with Aussie tax standards. Via phone online meetings or an email were keen to.

11 Best Crypto Tax Calculators To Check Out

At the top right click on the drop down menu on your account information and select.

. Quick simple and reliable. They can fall into. Crypto Tax Calculator Australia Coffs Harbour New South Wales.

Call 07 3088 9146. Calculate Your Crypto DeFi and NFT Taxes in as little as 20 minutes. The calculations produced are.

Generally the higher your. Crypto Tax Calculator for Australia. To lodge a tax return for the current tax year you will.

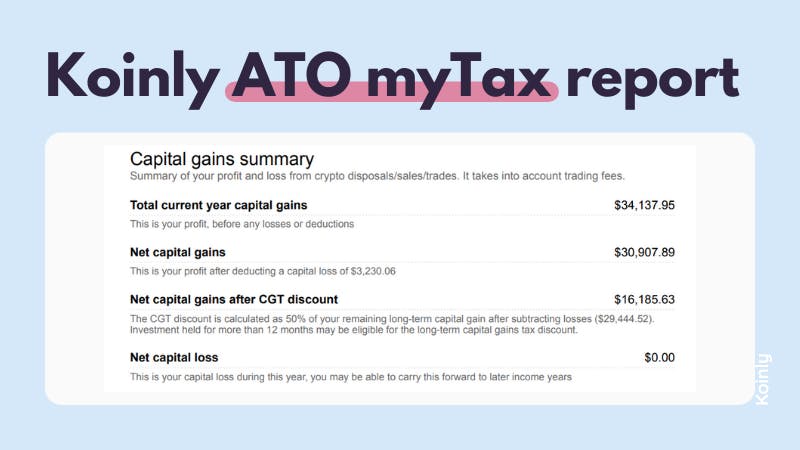

We can help you calculate your crypto tax in Australia with our simple and easy to use. For the purpose of estimating Janes CGT tax on her crypto asset alone we then apply this 325 tax rate to the 5000 capital gain included. The Australian Tax year will be operating between 1st July 2021 - 30th June 2022.

That way you can use our crypto tax calculator application today. Supports DeFi NFTs and decentralized exchanges. Reporting your crypto tax activity.

Check out our useful videos regarding our crypto tax calculator. If your crypto tax situation ever gets more complex feel free to try us out at cryptotaxcalculatorio were an. At Crypto Tax Calculator Australia we believe in affordable and simple pricing.

Looks like you managed to sort it out with Coinbase awesome to hear. The tax calculator calculates your taxes based on your income level. Create your free account now.

Sort out your crypto tax nightmare. June 27 2022. Use our free cryptocurrency tax calculator below to estimate how much CGT Capital Gains Tax you need to pay on any cryptocurrency sales.

In Australia your income and capital gains from cryptocurrency are taxed between 0-45. NFTs refer to nonfungible tokens which are digital objects that are verified on the blockchain and hold features such as uniqueness and non-interchangeability. The tax rate on this particular bracket is 325.

Plans Pricing All plans include coverage for every. Login to your Coinspot account. To lodge a tax return for the current tax year you will.

A crypto tax tool is a piece of software that allows you to calculate your cryptocurrency gains losses income and tax responsibilities. 653 likes 10 talking about this. The crypto tax calculator application combined with bookkeeping and client management is 249year.

Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Fullstack Provides The Best Crypto Tax Calculator in Australia With Over 20 Years of Experience. Your email will typically be responded to by one of the team within 24 hours of being received.

Reporting your crypto tax activity. The Australian Tax year will be operating between 1st July 2021 - 30th June 2022. It takes less than a minute to sign up.

Ethereum Solana and more.

![]()

Cointracking Crypto Tax Calculator

11 Best Crypto Tax Calculators To Check Out

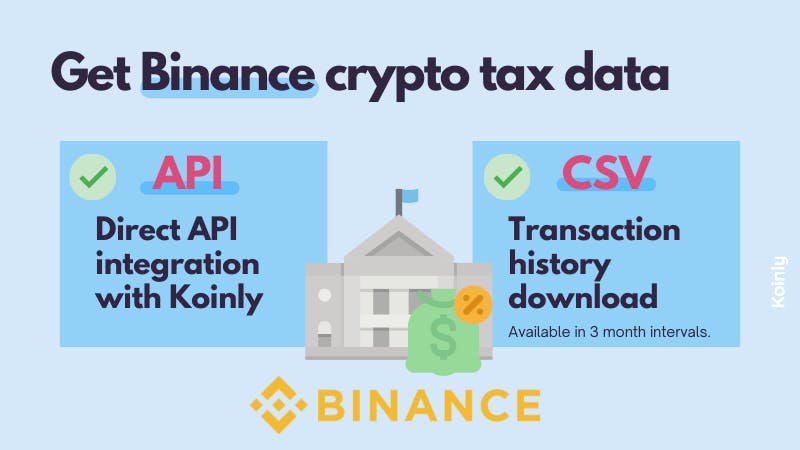

Top 10 Australian Exchanges For Crypto Taxes Koinly

9 Best Cryptocurrency Tax Calculator For Filling Crypto Tax 2021 Coinfunda

Cryptotaxcalculator Review 2022 Simplify Your Cryptocurrency Taxes

Coinledger Australia S Best Crypto Tax Software

14 Best Crypto Tax Software To Ease Your Calculation And Be Compliant Geekflare

Crypto Tax Calculator Australia Cryptoaustralia Twitter

Crypto Tax Prep We Help You Save On Taxes Kpoinly Koinly

11 Best Crypto Tax Calculators To Check Out

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Ultimate Australia Crypto Tax Guide 2021 2022 Cointracker

Crypto Tax Calculator Australia Cryptoaustralia Twitter

Capital Gains Tax Calculator Ey Us

Crypto Tax Calculator Australia How Aussies Can Calculate Their Crypto Tax Liability

Crypto Tax Calculator Australia Cryptoaustralia Twitter

Filing Your Australia Crypto Tax Here S What The Ato Wants Koinly